PAYROLL SOFTWARE FOR FRANCE

Payroll for France that puts you in charge.

WHAT YOU CAN DO

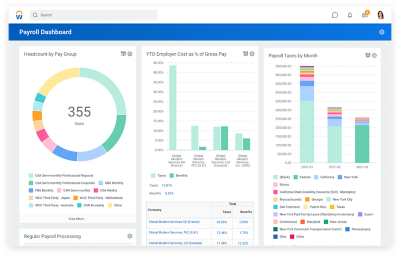

Manage payroll with greater agility.

Our team in France supports you with the flexibility, control, and insight that you need to run payroll your way.

Manage your HR and payroll from a single system and stay ahead of regulatory change with our payroll management software for France.

-

Continuous payroll processing

-

Real-time visibility

-

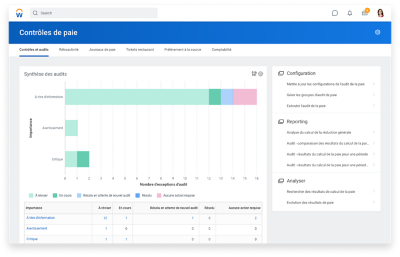

Configurable audits

-

Built-in reporting and analytics

-

Mobile-first employee experience

-

URSSAF, AGIRC-ARCCO, and tax withholding compliance

-

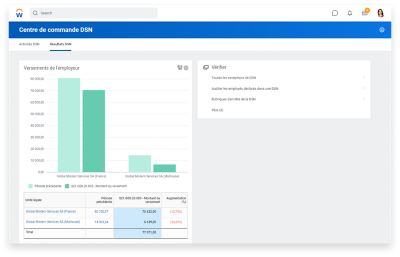

Built-in, automated DSN

“With Workday, we get total transparency and accessibility anywhere and at any time.”

Compliance par excellence.

We support evolving compliance needs for URSSAF, AGIRC-ARCCO, and tax withholding calculations. Built with DSN at the core, you get all the updates and reports you need, ready to use.

Flexibility to adapt to change.

Whether it’s your changing workforce, new regulations, or unique setups, Workday allows you to configure payroll to meet your needs.

Self-service for all your workers.

Workers can update personal information, enter time and absence, or request advance payments—and all data flows immediately to payroll.

“Our finance, HR, and payroll departments can now collaborate more effectively and eliminate data discrepancies. Essentially, our departments have gone from a purely operational, to a more strategic focus.”

Built-in support for DSN.

Our payroll management system for France provides built-in Déclaration Sociale Nominative (DSN) reporting. So keeping up with yearly DSN updates and reporting requirements is a snap.

Additionally, our connection with net-entreprises.fr enables seamless integration for retrieving BPIJ, tax rates, AER, and other acknowledgments (CRM).

Up-to-date contributions and tax calculation.

We deliver tax updates seamlessly in the cloud and show you exactly which changes are coming, when they take place, and how they affect your employees and organization.

The right level of payroll services.

Whether you want a fully outsourced payroll solution or a managed payroll service provider, Workday partners with experts such as Mercer and HRPath to help. With us, you gain the flexibility to dial payroll services up or down, while still maintaining payroll control and visibility.

Manage payroll your way.

We provide a broad spectrum of global enterprise payroll capabilities that simplify your processes and evolve with your needs. So you can gain the control, flexibility, and insight to configure and run payroll your way.

See how we get

you live fast.