Accounting Center

Turn accounting into rich financial insight.

Workday Accounting Center transforms high volumes of business events into journal entries, giving you the insight you need to tell the full story of your organization.

WHAT YOU CAN DO

Manage accounting with ease.

Workday brings front-office systems, operations, and the back office together to automate the transformation of business events into accounting. This simplifies the close and saves you time, allowing you to reduce variances faster while providing deeper insight into your business.

-

High-volume data integration

-

Accounting transformation

-

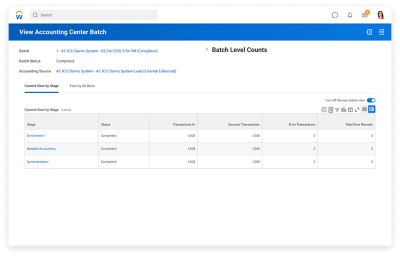

Process orchestration

-

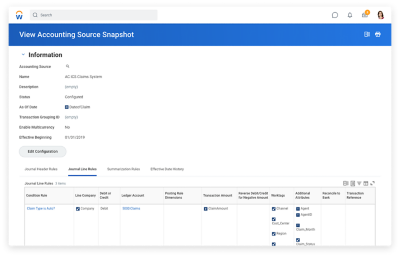

User-defined rules

-

Automated error handling

-

Complete data lineage

-

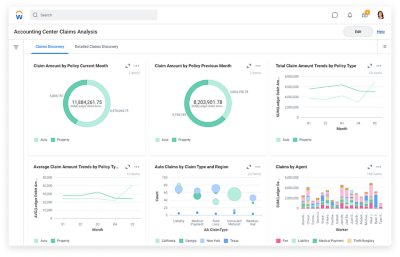

Financial and operational analysis

Elevate your accounting team.

Quickly turn data into insight.

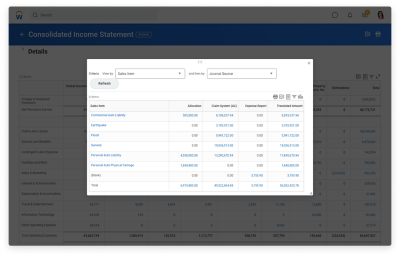

What do you get when you blend third-party revenue and operational data with Workday data? A rich source of truth that you can dig into for deeper analysis.

Gain visibility and control over data.

Own the data transformation process—starting with ingesting operational data, then enriching with calculations, creating accounting, and resolving errors.

Make processes more efficient.

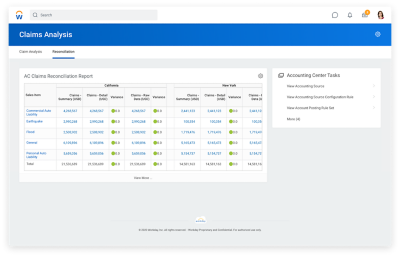

With all accounting in one solution, you can simplify reconciliation and consolidation to achieve a faster and more accurate close.

Manage the rules your way.

Our accounting rules engine is written in business language, not code—so it’s easy for your accounting team to maintain and modify the rules as needed.

Quickly turn data into insight.

What do you get when you blend third-party revenue and operational data with Workday data? A rich source of truth that you can dig into for deeper analysis.

Gain visibility and control over data.

Own the data transformation process—starting with ingesting operational data, then enriching with calculations, creating accounting, and resolving errors.

Make processes more efficient.

With all accounting in one solution, you can simplify reconciliation and consolidation to achieve a faster and more accurate close.

Manage the rules your way.

Our accounting rules engine is written in business language, not code—so it’s easy for your accounting team to maintain and modify the rules as needed.

“We’ve been able to retire our custom legacy solution, simplify our processes, and improve financial reporting and analysis, data lineage, flexibility, and scalability.”

Set a new standard for insight.

Explore your P&L by line of business, product, sales region, and salesperson. And use powerful ad hoc reporting to get more meaningful insights, update forecasts faster, and speed up decision-making.

Easily meet audit requirements.

Our always-on audit automatically tracks and documents changes to rules and mappings. This makes it easy for you to monitor and provide the control and compliance required by auditors.

Trusted and proven for your needs.

Revenue recognition.

Transform operational data—such as policy, media production, or technology order data—into accounting to recognize revenue, including deferred revenue.

Expense recognition.

Record expenses from business events, including deferred and prepaid expenses, to match revenue.

Cash subledger.

Record cash sales, credit card sales, billings, and payments from cash transactions into accounting.

Detailed subsidiary insight.

Create a virtual subledger to transform summarized journals into more granular detail for richer reporting.

See how we help you succeed.