ACCOUNTING AND FINANCE SOFTWARE

Intelligently automate your general ledger

See how Workday can help you improve compliance and drive efficiency across your entire finance function while simplifying routine tasks.

WHAT YOU CAN DO

Unlock more time to drive value with AI

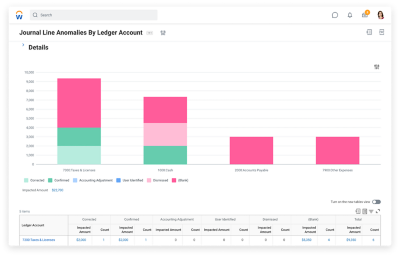

Our embedded AI spans all finance processes – continuously detecting anomalies, identifying exceptions and making recommendations. By eliminating manual tasks, you can improve efficiency and focus on strategies that drive business forever forward.

-

General ledger

-

Accounts payable and receivable

-

Fixed-asset management

-

Cash management

-

Revenue management

-

Global consolidation

-

Financial reporting and analytics

Accelerate time to action with data-driven decisions

Continuous accounting for in-the-moment insight

See the impact of your transactions as they happen with continuous accounting. And quickly identify and address issues for easier analysis.

Assess the financial impact of business events

Workday transforms operational transactions into detailed accounting so you can see your full financial picture all in one place.

Consolidate in real time for a faster close

Why wait for period-end to view results? Automatically create accounting in real time for an in-the-moment view into consolidated financial performance.

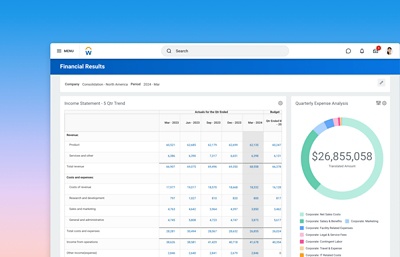

Multidimensional analysis from any report

Analyse transactions and accounting, compare budget versus actuals and blend financial and operational data – all in the same system.

Drill into your data and share results

Unite data from any source for a more comprehensive analysis – and when it’s time to report, quickly produce financial statements, KPIs, scorecards and more.

“The automation we’ve put in place and the efficiencies we’ve gained because we have all this data in one location has been tremendous for our team.”

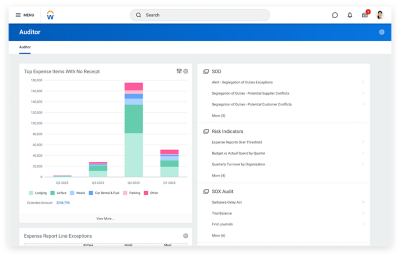

Continuous auditing for peace of mind

Always-on audit lets you configure workflows for every process and transaction, set standardised controls and track changes in real time – saving your business both time and money.

Efficient accounting for effective finance

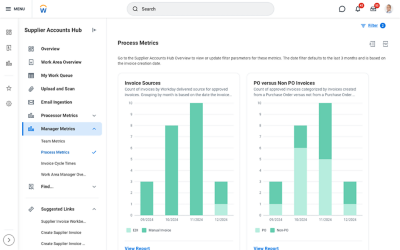

Pay suppliers with ease

Seamlessly set up suppliers, manage invoices and process approvals – and automate payments and other processes to improve accuracy and reduce errors.

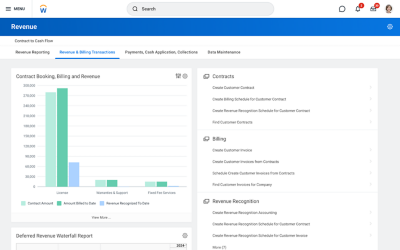

Take care of your customer lifecycle.

Manage contracts, billing, collection, accounting and analytics from a single system. With Workday, you can streamline processes and focus more on customer needs.

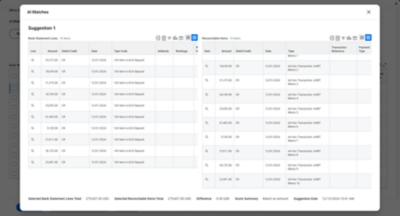

Automate and control your cash flow

Get real-time cash insights, connect seamlessly with your banks and use embedded AI to automate bank reconciliations.

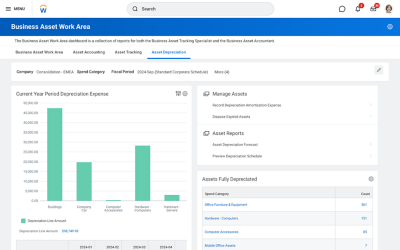

Manage assets from acquisition to disposal.

Account for assets throughout their lifecycle. We deliver complete visibility into their history, from procurement to disposal.

Pay suppliers with ease

Seamlessly set up suppliers, manage invoices and process approvals – and automate payments and other processes to improve accuracy and reduce errors.

Take care of your customer lifecycle.

Manage contracts, billing, collection, accounting and analytics from a single system. With Workday, you can streamline processes and focus more on customer needs.

Automate and control your cash flow

Get real-time cash insights, connect seamlessly with your banks and use embedded AI to automate bank reconciliations.

Manage assets from acquisition to disposal.

Account for assets throughout their lifecycle. We deliver complete visibility into their history, from procurement to disposal.

Turn your data into action

Workday Illuminate™ optimises finance processes – freeing your team to be more strategic. By shifting from value tracker to value creator you can boost efficiency, accuracy and insights while driving smarter decisions across your business.

A Leader in Gartner® Magic Quadrant™ for Cloud ERP for Service-Centric Enterprises

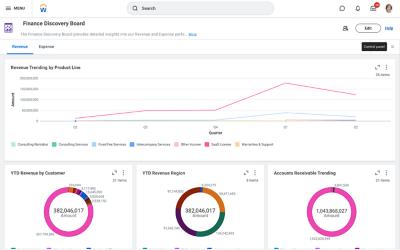

A consistent source of truth for FP&A and accounting.

With a seamless flow of information, FP&A gains immediate access to actuals, empowering more continuous planning. And accounting can understand performance relative to budget at all times.

See how we help you succeed